Student Loan Forgiveness: Not Everything is About You

Photo from Pexels by John Guccione

Bronwyn Rhoades

On August 24, 2022, President Biden announced his three-part plan intended to forgive a significant amount of student debt for borrowers in the United States. As with any political decision of this scale, many have voiced their extreme opposition to both the act itself and to its potential effects on many Americans.

Before any opinion about the matter can be derived, one must completely understand the contents of this executive action.

The first part of this plan involves extending the pause of student loan payments. A pause was placed on all student loan payments in March 2020 and has been extended numerous times in order to provide borrowers more flexibility. The pause has been extended once again, until December 31, 2023.

The second part of Biden’s plan is the center of controversy. It focuses on the forgiveness of current student debt in order to provide relief to those struggling to make payments. Any individual making under $125,000 or any married couple/head of household making under $250,000 may receive up to $10,000 in relief. Those who qualify and have received a Pell Grant-a government grant that awards need-based financial aid for post-secondary school- while in college may receive up to $20,000 in forgiveness. One cannot earn more relief than their level of debt. For most who qualify, there is no application process. Because the government already has income information for a majority of households, the debt will automatically be forgiven unless one chooses to “opt-out.” If the government does not have such information, households will have the opportunity to fill out an application for relief.

Finally, the third part of Biden's plan involves making loan payments more bearable for most households. Essentially this portion of the bill ensures that future borrowers will not have to make payments that present an extreme burden, especially for those below the federal poverty level.

Since the announcement of this bill was made, many different opinions have been expressed. Multiple lawsuits have been filed against the Biden administration because of his executive order. While some of these cases were immediately struck down by judges, some have yet to be heard. Potentially the most prominent of these lawsuits is one in which six states argue that not only does the president not have the authority to roll out such a plan, but it would also incur economic harm to many states. Along with this, the senators called the plan “downright unfair.” In order to prove these claims, the states must have legal standing for their lawsuit, meaning they can provide specific evidence that displays the harm caused by the executive order. I am not a legal expert and therefore will not attempt to decipher or argue the legality of the order/lawsuits. However, this lawsuit brings up the controversial morals regarding student loan forgiveness.

Many politicians, lawyers, and civilians have expressed frustration in relation to the aforementioned “fairness” of the bill. Most of these arguments pertain to the taxes that will allow the loans to be forgiven. According to CNBC, taxpayers may owe around $2,500 in taxes due to the loan forgiveness. This, of course, will likely differ based on one’s tax bracket.

The phrase, “Why should those who pay off their loans be punished?” has become common ever since the bill was announced. This statement has certain fundamental flaws that contradict the modern political-economic state of the United States, as well as the morals that most already consider.

The concept of paying for a program that you are not a direct beneficiary of is not uncommon in the economic system of this country. One obvious example of this involves Social Security payments. Almost every working individual pays Social Security taxes on their income, despite the fact that they themselves do not immediately benefit from these payments. In fact, due to longer lifespans of aging individuals, these security tax reserves are depleting far quicker than they can be replenished. Therefore, younger individuals who are currently paying social security tax may see little to no payout when they reach retirement age. Despite this, taxpayers will continue to pay social security.

The Department of Veteran Affairs planned to spend around 250 billion dollars in 2022. Beginning in the 1800s, many taxpayers have been supporting veterans, despite never serving themselves. They continue to do so not only because it will ideally improve the economy and safety of the country, but also because it is the moral thing to do.

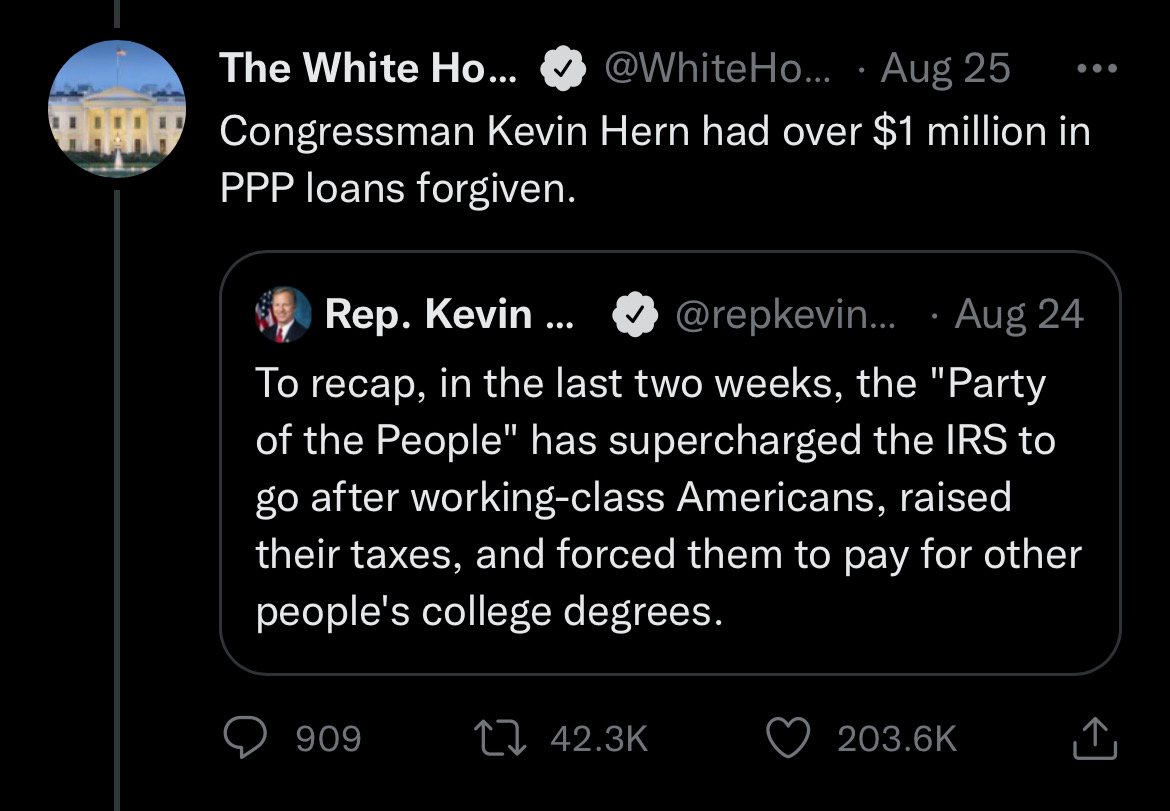

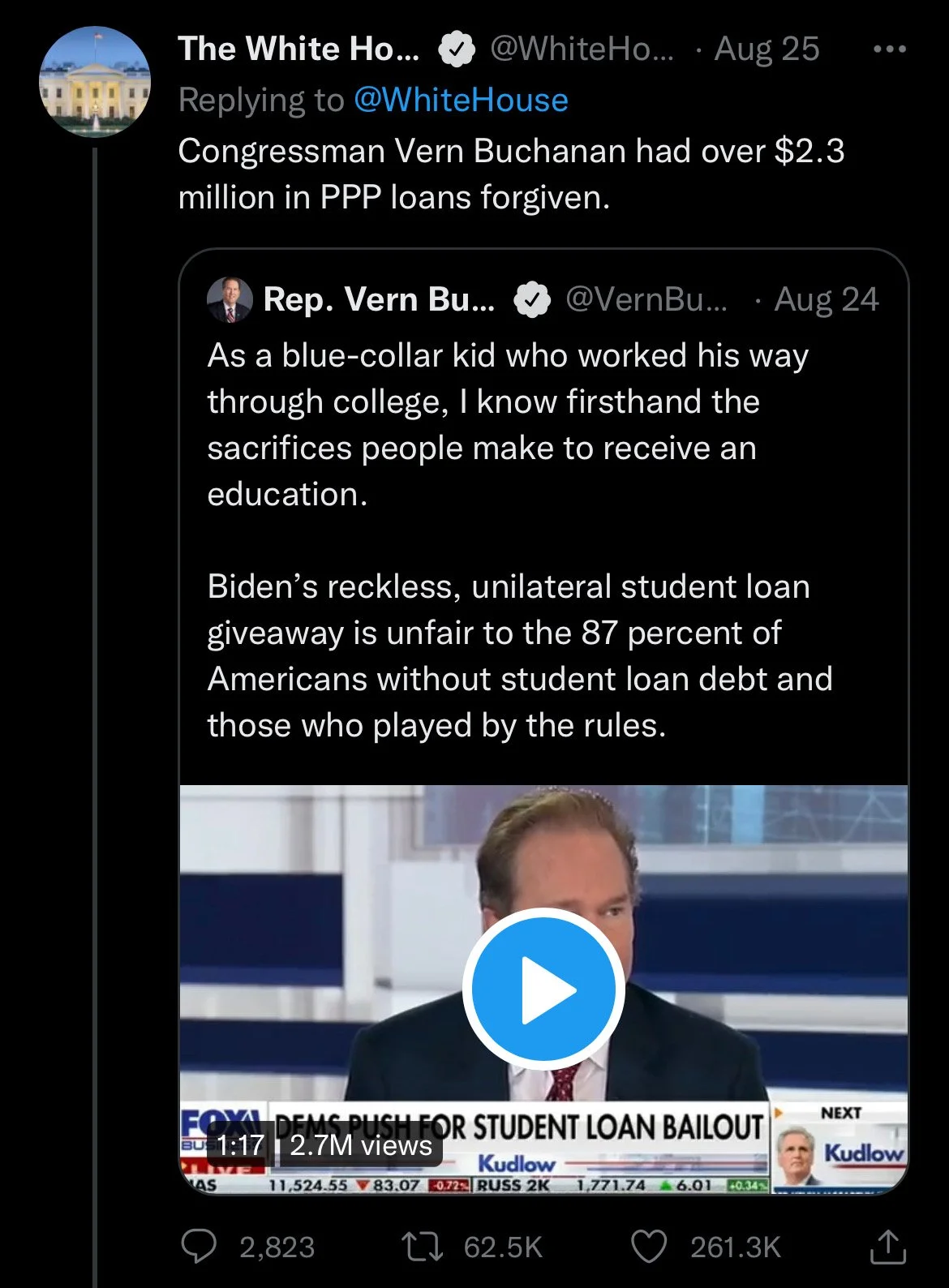

During the COVID-19 pandemic, almost 800 billion dollars worth of “Paycheck Protection Program” loans were awarded to businesses around the country, almost 400 billion dollars of which were forgiven. While this program went far over budget, many of its benefactors spent their money on luxury vehicles, homes, and more. In this instance, the government provided relief to many wealthy individuals using taxpayer money. Many who paid these taxes never qualified for a PPP loan. Nonetheless, these taxes were paid with the hope that the overall economy would benefit.

Time and time again, taxpayers have participated in programs that do not directly benefit them. So why has the line suddenly been drawn now? The controversy boils down to two different reasons.

The first is anger from elite lawmakers and businessmen/businesswomen that feel anger towards the lower class. The common notion of upper-class individuals of “it doesn’t benefit me, so it shouldn't benefit you,” is a display of the innate individualistic behavior of many capitalist societies. In order for the national economy to thrive, our society must develop into one that considers the prosperity of the entire country.

The second involves the divisive current political nature of this country. Each political party has weaponized decisions made by the other side in order to boost their respective reputations. Many conservatives, including those arguing the mentioned lawsuit, have used this order to debase President Biden and the Democratic party.

Policies such as this loan relief have been used in this country for hundreds of years, and this will not likely be the last of its kind. Without the help of others, this country would be without roads, healthcare, and veteran assistance. The question of legitimacy over student loan forgiveness is not one of “fairness,” it is one of the ideals of those in power, and how they can weaponize the opinions and actions of others.